When it comes to mastering the art of stock market trading, understanding how to read stock charts is your gateway to success.

In this article, we’ll walk you through the ins and outs of interpreting stock charts and equip you with the skills to make informed trading decisions. Today, our primary focus is on the chart of Trust SPDR S&P Biotech (Ticker: XBI), an opportunity-packed asset in the realm of biotech stocks. Let’s start by breaking down the basics of reading stock charts.

✏️ Table of Contents

🔔 Today’s Stock Pick

Trust SPDR S&P Biotech (Ticker: XBI)

Trust SPDR S&P Biotech (XBI) tracks an equal-weighted index of US biotechnology stocks, providing exposure to the world of biotech as defined by GICS, from small to large market-cap companies. Understanding how to read stock charts is essential for evaluating and trading stocks like XBI.

💡 Dive into the Technical Points

● Head & Shoulder Pattern

XBI is currently showing signs of forming a Head & Shoulder pattern, a widely recognized technical chart pattern. This pattern typically consists of three peaks, with the middle peak (the “head”) being higher than the other two (the “shoulders”). In XBI’s case, it appears to be hitting the “neckline,” a key level of support and resistance. The formation of this pattern suggests a potential trend reversal, which investors should closely monitor.

● Oversold Relative Strength Index (RSI)

Currently residing in the oversold zone, the RSI suggests that the stock may be undervalued. This zone often prompts investors to consider potential entry or exit points, as it may indicate an opportunity to capitalize on price movements.

What makes the RSI even more intriguing in the case of XBI is its proximity to a level where it has historically bounced. This historical behavior adds another layer of significance to the current RSI reading. It could potentially serve as a signal that a price reversal is on the horizon, making this a critical juncture for traders and investors.

● Possibility of a Bounce to 200dEMA

In the coming week, there’s potential for a rebound from neckline support towards the 200-day Exponential Moving Average (200dEMA), a significant long-term support/resistance level.

A rebound from the neckline to the 200dEMA signals a bullish sentiment, suggesting possible upward momentum. Conversely, breaching this level may indicate a bearish sentiment and the potential for a downward trend.

Caution is advised when the price approaches the 200dEMA, as it can act as a formidable resistance level.

✏️ Technical Tips of How to Read Stock Charts

*Neck Line*

The ‘Neck Line‘ is a critical component of the Head & Shoulders chart pattern, where it represents a horizontal line connecting the low points of the two ‘shoulder’ peaks.

Conversely, in the case of the Inverse Head & Shoulders pattern, the ‘Neck Line’ remains a horizontal line, but with a different role. Instead of connecting the low points of the ‘shoulder’ peaks, it joins the high points.

This line functions as a crucial support/resistance level for the asset’s price. When the price falls below this line, it can signal confirmation of the Head & Shoulders pattern, potentially leading to a downward trend. On the other hand, if the price bounces off this line, it may suggest a bullish reversal. The dynamics of the ‘Neck Line’ are the opposite in the Inverse Head & Shoulders pattern.

Understanding the ‘Neck Line’ in both the Head & Shoulders and Inverse Head & Shoulders patterns is essential for traders and investors to learn how to read stock chart. It provides valuable insights into potential trend reversals, empowering decision-making in the realm of stock chart analysis.

🏹 For The Success Of Your Trading

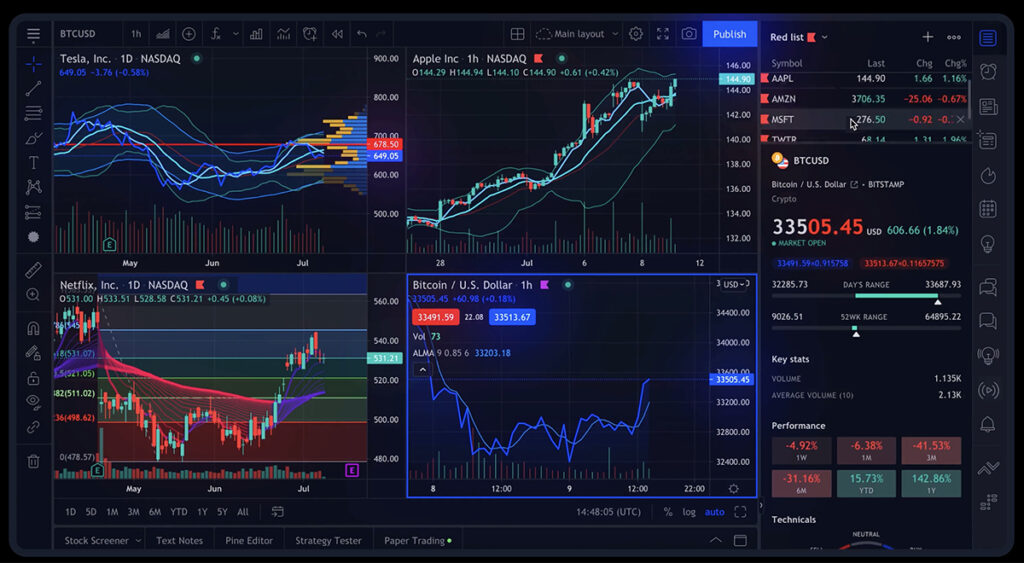

As we delve deeper into the world of stock market technical analysis, having access to reliable and comprehensive tools becomes paramount for making informed trading decisions. In my daily trading, I rely on TradingView, an exceptional platform for stock chart analysis.

TradingView offers a plethora of features and tools that empower traders and investors to conduct thorough chart analysis. To explore the benefits of TradingView, take a look my comprehensive review in the article “How TradingView Can Change the Game for Traders” You can also access the platform directly here.

🍵 Conclusion

In conclusion, our in-depth analysis of today’s XBI chart reveals compelling opportunities that merit close attention from traders and investors. The presence of a Head & Shoulder pattern in XBI’s chart is a noteworthy development. This widely recognized technical chart pattern suggests a potential trend reversal. The fact that XBI is hitting the “neckline adds further weight to this pattern.

Furthermore, the Relative Strength Index (RSI) for XBI is currently in the oversold zone, indicating that the stock may be undervalued. Also, the chart analysis suggests the potential for a rebound aiming for the 200-day Exponential Moving Average (200dEMA) in the coming week.

Traders and investors alike should take note of these critical technical indicators. These insights are not only valuable for making informed trading decisions but also for potentially capitalizing on the opportunities presented by XBI and the broader world of stock market trading. By understanding how to read stock charts and harnessing the power of technical analysis, you can enhance your trading strategies and navigate the complex landscape of the stock market with confidence and precision.

🌿 FAQs

Q1: Can I use stock charts for any type of stock or asset?

Yes, stock charts can be used for analyzing stocks, cryptocurrencies, commodities, and more. The principles of technical analysis remain similar.

Q2: What’s the best timeframe for a beginner to start with when reading stock charts?

For beginners, it’s often recommended to start with daily charts, as they provide a good balance between short-term and long-term trends.

Q3: What is a Head & Shoulder pattern, and why is it important in stock chart analysis?

A Head & Shoulder pattern is a widely recognized technical chart pattern that typically consists of three peaks. The middle peak, known as the “head,” is higher than the other two, referred to as the “shoulders.” This pattern is important in stock chart analysis because it often signifies a potential trend reversal. Traders and investors use it as a crucial indicator to make informed decisions.

Q4: How does the Relative Strength Index (RSI) work, and why is it significant for stock analysis?

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It’s important for stock analysis because it helps identify overbought or oversold conditions. When the RSI is in the oversold zone, it suggests that the stock may be undervalued, potentially indicating a buying opportunity. Conversely, an overbought RSI could signal a potential sell-off.

Q5: What is the significance of the 200-day Exponential Moving Average (200dEMA) in stock chart analysis?

The 200-day Exponential Moving Average (200dEMA) is a long-term moving average that acts as a strong support or resistance level. In stock chart analysis, it’s significant because it provides insights into a stock’s long-term trend. If a stock’s price approaches or bounces off the 200dEMA, it can be a critical indicator for traders and investors, helping them make decisions based on a stock’s long-term performance.

Q6: Can the insights gained from XBI’s chart analysis be applied to other stocks and assets?

Yes, the insights gained from XBI’s chart analysis can be applied to other stocks and assets. The principles of technical analysis, including pattern recognition and key technical indicators, are relevant across various assets, including stocks, cryptocurrencies, commodities, and more. Understanding these principles can help you make informed decisions in the broader world of trading and investment.

Q7. Can you recommend any specific online courses for learning technical analysis and how to read stock charts?

Certainly, if you’re looking for specialized online courses to enhance your knowledge of technical analysis and stock chart reading, you might consider checking out StockOdds. They offer a range of educational resources and insights that can help you sharpen your stock market technical analysis skills.

StockOdds provides a variety of courses that cater to both beginners and experienced traders, allowing you to delve deeper into the world of stock market analysis. Additionally, you can explore books, webinars, and seminars from trusted experts to further hone your skills in this field.

For a comprehensive look at StockOdds, delve into our detailed review in the article titled: “Unveiling the Best Stock Trading Course: A Comprehensive Review of StockOdds“.

Q8. Where can I access real-time stock chart?

When it comes to real-time stock charts, look no further than TradingView, a platform that I personally use and highly recommend.

TradingView is more than just a charting tool; it’s a comprehensive online trading platform that offers a rich toolkit for traders. With its user-friendly interface, a wide range of technical indicators, and the ability to customize your charts, it’s considered by many as the best platform for in-depth stock chart analysis.

Whether you’re a novice or an experienced trader, TradingView provides the real-time data and tools you need to make well-informed trading decisions in today’s dynamic market.

👉👉 Connect with Me: Instagram and StockTwits ✌️