As we begin our exploration of stock signals, imagine a world where your trading decisions are guided by precision and insight. In today’s rapidly evolving financial landscape, investors are constantly seeking innovative tools and strategies to gain an edge in the stock market.

One of the most intriguing developments in recent years is the emergence of AI-powered trading signals and the age-old practice of copy trading led by human expert traders.

In our earlier discussion, we explored 3 Top Forex Trading signals, and now it’s time to shift our focus. In this comprehensive article, we will delve into the world of stock signals, comparing two top-notch providers: Tickeron‘s AI trading signals and eToro‘s CopyTrader solution.

Our goal is to help you make an informed decision on which signals are better suited to your trading objectives.

✏️ Table of Contents

📲 Tickeron’s AI Trading Signals

Tickeron is at the forefront of AI-powered trading platforms. Its core strength lies in using advanced artificial intelligence to provide traders with valuable insights and recommendations.

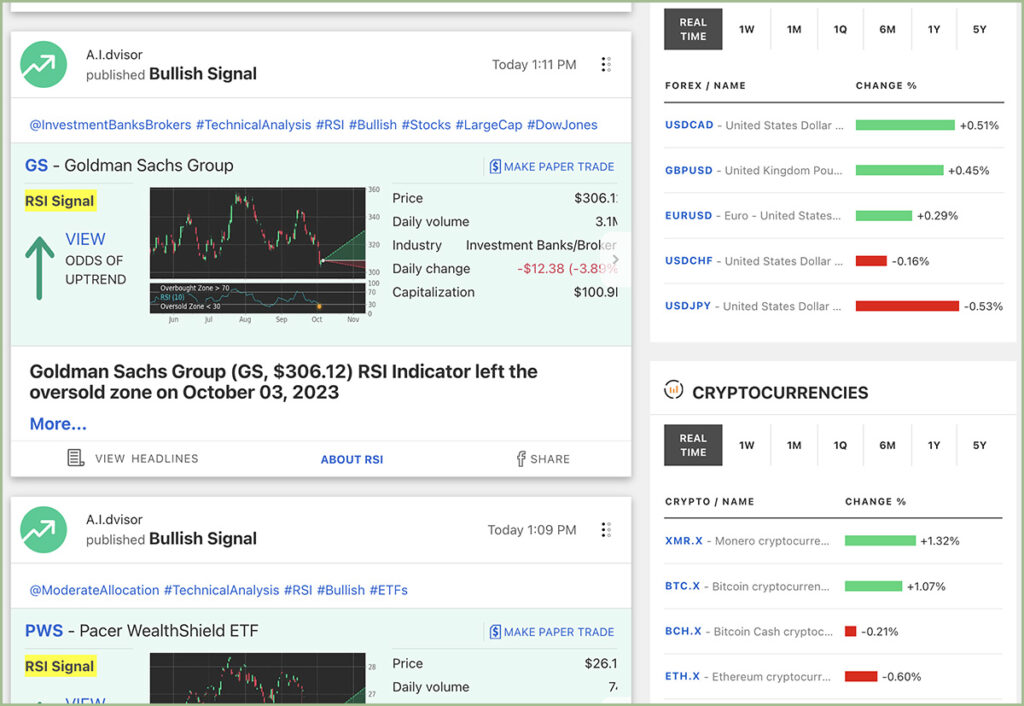

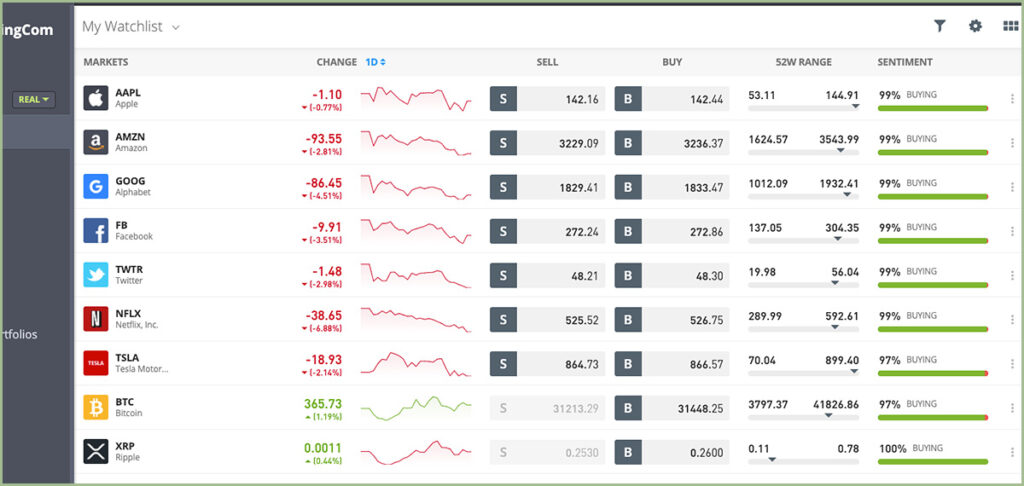

One of Tickeron’s standout features is its proven trading signals and alerts, generated by its robust AI algorithms (AI Robots). These signals serve as invaluable tools for traders, providing guidance on optimal entry and exit points across a wide spectrum of financial instruments, including stocks, options, and cryptocurrencies. Tickeron’s trading signals empower traders with timely, data-driven insights that align with their investment strategies.

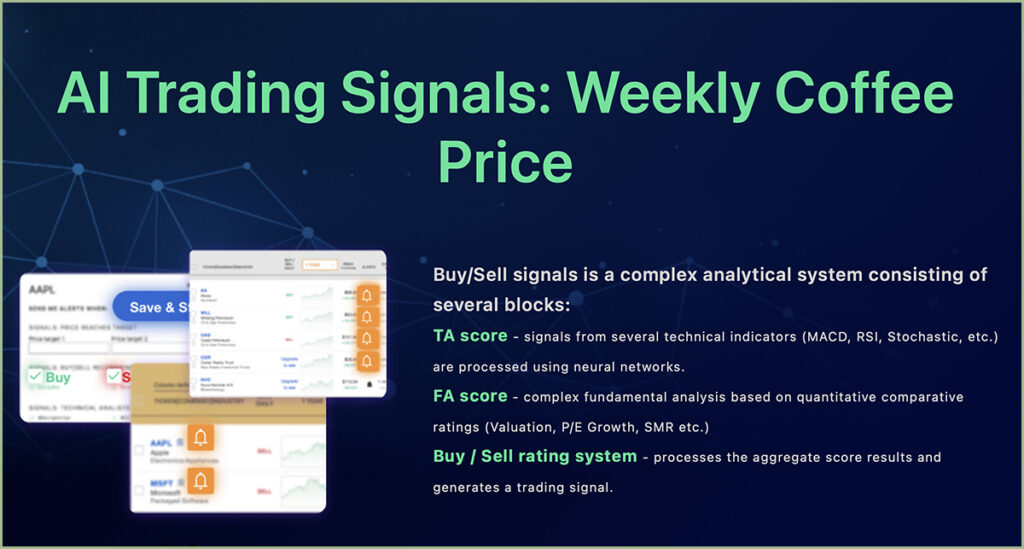

🟢 High-Probability Trading Signals

Tickeron’s stock signals are the result of a comprehensive system that combines technical analysis (TA score) with fundamental analysis (FA score) and a rating system. The result is Impressive 90% Odds of Success, backed by AI calculations across different asset classes. This means you can trade with more confidence. These signals cover a wide range of assets, including stocks, ETFs, and more.

🟢 Beyond Signals: Tickeron’s Extra Benefits

Trading isn’t just about one signal; it’s about having the right tools. Tickeron offers a customizable news feed that lets you explore stocks in-depth. This helps you make well-informed decisions by providing you with valuable insights.

🟢 The “Odds of Trading Success

Tickeron believes in using AI to analyze a wide range of indicators. Their “Odds of Trading Success” formula, powered by AI, reviews past outcomes to give you insights into the likelihood of similar events happening again. With Tickeron’s AI-driven backtesting, you can make smarter decisions and increase your chances of success.

🔔 How to Receive Alerts on Tickeron stock Signals

Each day, after the trading session concludes, Tickeron’s mathematical algorithms process new End-of-Day prices and generate fresh recommendations. If there’s a change in the signal direction for a specific ticker, a notification with the new recommendation is promptly sent to your “My Notifications” page or email.

This update ensures that you have the latest information at your fingertips to make informed trading decisions based on End-of-Day data.

🌐 Explore Tickeron: AI-Powered Trading Platform

Tickeron is a financial technology company that specializes in providing artificial intelligence-driven trading and investment tools for traders and investors in the stock market and other financial markets. Tickeron, a groundbreaking platform, is setting a new standard by harnessing the formidable power of artificial intelligence (AI) to elevate trading and investment decisions to unprecedented levels of accuracy and sophistication.

❇️ AI-Powered Trading Brilliance:

Tickeron’s standout feature is its utilization of AI and machine learning algorithms to provide traders with actionable insights. By analyzing vast datasets and market trends, Tickeron’s AI algorithms generate trading signals, identify patterns, and predict potential market movements. This can save traders significant time and effort in conducting technical analysis manually.

❇️ Simplified Technical Analysis

No matter your experience level, Tickeron’s technical analysis tools are a game-changer. Whether you’re delving into stocks or cryptocurrencies, the platform’s arsenal of charts and indicators provides indispensable insights. Dive into historical data, dissect chart patterns, and harness moving averages to fine-tune your trading strategies.

❇️ Knowledge Empowerment

Tickeron doesn’t just provide tools; it’s a hub of knowledge. For those looking to enhance their trading prowess, the platform offers a treasure trove of educational resources. From immersive webinars to step-by-step tutorials and insightful articles, Tickeron is your gateway to mastering the art of trading.

❇️ Tailored Alerts and Real-Time Updates

Tickeron enables users to set up personalized alerts and notifications. Traders can define specific criteria, such as price levels or technical indicators, and receive real-time alerts when those conditions are met. This feature allows traders to stay informed about market developments even when they’re not actively monitoring their portfolios.

❇️ Risk Mitigation

Effective risk management is paramount in trading, and Tickeron offers tools to help users protect their investments. Traders can implement stop-loss orders and assess risk-reward ratios to make informed decisions about their positions. These risk management features can help mitigate potential losses in volatile markets.

❇️ Seamless Brokerage Integration

Tickeron seamlessly integrates with a range of brokerage platforms, simplifying the process of executing your trades. This synergy between analysis and execution ensures that you can swiftly act on the robust trading signals generated by the platform.

❇️ Pricing

Tickeron offers flexible pricing plans to cater to traders with diverse needs and budgets. With various subscription tiers, you can find the perfect plan that aligns with your trading objectives, ensuring that you get maximum value for your investment.

❇️ Intuitive Interface

Navigating Tickeron’s sleek and intuitive interface is a breeze. Even if you’re new to trading or technical analysis, you’ll find yourself comfortably at home. The platform’s minimalist design and well-structured features ensure that you can access the tools and information you need with ease.

❇️ World-Class Customer Support

Trading never sleeps, and neither does Tickeron’s commitment to customer support. While experiences may vary, Tickeron is dedicated to promptly addressing your inquiries and technical issues, ensuring you can trade with confidence.

🌐 Tickeron: Pros and Cons

🔽 Pros:

- 🔸 AI-Powered Trend Prediction: Harness the power of AI trend prediction engines for enhanced decision-making.

- 🔸 Real-Time Pattern Recognition: Benefit from real-time pattern recognition across 40 stock, ETF, Forex, and crypto assets.

- 🔸 Diverse Trade Ideas: Access a diverse array of trade ideas through 45 streams, offering ample trading opportunities.

- 🔸 AI Portfolio Building: Simplify portfolio construction with AI-driven assistance, optimizing your investment choices.

- 🔸 Efficient Monitoring: Stay informed with a well-organized system for monitoring financial market and stock market data.

- 🔸 Top-Notch Tools: Utilize high-quality trading tools and strategies to enhance your trading experience.

- 🔸 Inclusive Platform: Whether you’re a beginner or a seasoned professional, Tickeron caters to traders of all levels.

- 🔸 Extensive Resources: Enjoy access to a wide range of resources, making Tickeron a comprehensive trading platform.

- 🔸 Valuable Tips: Find articles and tips on web usage that contribute to a well-rounded trading experience.

- 🔸 Boosted Success Odds: Tickeron’s analytical system for buy/sell signals boasts a remarkable 90% Odds of Success.

🔽 Cons:

- 🔹 Limited Custom Charting: Custom charting options are limited, potentially affecting advanced chart analysis.

- 🔹 Inability to Plot Indicators: Tickeron lacks the capability to plot certain indicators, which may limit technical analysis options.

📲 eToro’s Copy Trading Signals

eToro, a renowned name in the investment sphere, offers a popular solution known as CopyTrader.

This innovative feature allows allows users to automatically replicate the trading strategies of experienced and successful investors in real-time. This feature has gained immense popularity among traders and investors, making it one of the standout features of eToro.

🟢 Handpick Your Trading Signals

eToro empowers traders by offering the flexibility to choose which signals they want to replicate on their platform. By selecting a professional trader’s trades to follow, you can automate your trading journey. This service is brought to you by eToro’s CopyTrader.

🟢 Signals for All Markets

Whether your interests lie in currencies, cryptocurrencies, commodities, indices, stocks, or exchange-traded funds (ETFs), eToro’s CopyTrader has you covered. These signals are provided free of charge. You won’t incur separate fees for copying signals. The compensation for the traders whose signals you copy is handled through eToro’s Popular Investor Program.

Moreover, eToro’s Popular Investor Program supports those who wish to offer their own day trading signals for others to copy, providing compensation for their expertise.

🔔 How to Receive eToro Stock Signals

eToro’s trading signals are delivered in an automated fashion, transmitted from a copied trader’s account. This eliminates some of the problems associated with other signal formats, such as delays, missed signals, or confusion in interpretation. With eToro, you receive signals efficiently, ensuring timely execution.

🌐 Explore eToro: Unlock Social Trading Power

In the dynamic landscape of online trading, eToro emerges not just as a platform but as a transformative force – a revolution in the world of investments. It’s not merely about charts and numbers; it’s about harnessing the collective wisdom of a community of traders.

❇️ The Magic of Social Trading

eToro’s claim to fame is its pioneering concept of social trading. This innovative approach allows traders to follow and even copy the strategies of expert traders. It’s like having a backstage pass to the trading strategies of the pros, and it’s leveling the playing field for traders of all backgrounds.

❇️ A Bounty of Assets

eToro isn’t confined to one corner of the market; it opens the doors to a vast array of assets. Whether you’re inclined towards stocks, cryptocurrencies, commodities, forex, or more, eToro provides access to a diverse universe of possibilities, allowing you to craft a portfolio that’s truly yours.

❇️ The CopyTrader Marvel

At the heart of eToro’s social trading brilliance is the CopyTrader feature. Imagine having the power to mirror the trading moves of your chosen expert traders automatically. It’s like having a trading guru by your side, an ideal solution for both newcomers and those who prefer a hands-off approach.

❇️ A Treasure Trove of Knowledge

eToro doesn’t stop at being a trading platform; it’s also your gateway to knowledge. Dive into a wealth of educational resources, from live webinars to step-by-step tutorials and an ever-thriving online community. eToro is where you not only trade but also grow as a trader.

❇️ User-Friendly Bliss

Navigating eToro’s platform is smooth and hassle-free trading experience. Its user-friendly interface is designed to cater to traders of all levels, offering a clean and intuitive experience. Whether you’re a seasoned trader or a fresh recruit, eToro welcomes you with open arms.

❇️ Innovation on Steroids

eToro is a hub of innovation, constantly introducing features to elevate your trading experience. Explore CopyPortfolios, a unique way to invest in diversified portfolios curated by top traders. Or consider the Popular Trader program, which rewards successful traders with additional income. The future of trading is here, and it’s with eToro.

❇️ Security and Regulation

eToro takes security and regulation seriously. The platform is rigorously regulated across multiple jurisdictions and employs state-of-the-art encryption to safeguard user data and funds. Your safety is their priority.

❇️ Stay Connected on the Go

eToro’s mobile app ensures you’re never disconnected from the markets. With full functionality and a user-friendly interface, you can manage your portfolio and seize opportunities wherever you are.

❇️ Pricing

eToro’s pricing structure offers affordability for traders and investors, with commission-free U.S. stock trading being a standout feature. However, fees can vary depending on the asset class and market conditions, so it’s essential to review the specific costs related to your trading strategy.

❇️ Customer Support at Your Service

eToro offers customer support through various channels, including the ever-helpful live chat. While response times may vary, eToro is dedicated to addressing your inquiries and technical issues promptly.

🌐 eToro: Pros and Cons

🔼 Pros:

- 🔸 High Reliability: eToro is regulated by respected authorities and participates in compensation funds, providing a secure trading environment.

- 🔸 Wide Asset Selection: Gain access to assets from major stock exchanges in the UK, U.S., Australia, and Asia, diversifying your investment opportunities.

- 🔸 Zero-Fee Trading: Enjoy cost-effective trading with the ability to trade certain stocks without incurring additional fees.

- 🔸 Portfolio Diversity: Access diversified portfolios with varying risk levels, allowing for a well-rounded investment approach.

- 🔸 Leverage and Education: Benefit from leverage availability, comprehensive educational materials, and user-friendly trading platforms that enhance your trading skills.

- 🔸 Fee-Free Services: eToro offers fee-free portfolio management, deposits, and account maintenance, ensuring transparency in your trading costs.

- 🔸 Automated Copying: eToro’s CopyTrader system automates the copying process, reducing manual effort and making trading more accessible.

- 🔸 Cost-Effective: There are no extra charges for using the CopyTrader service; eToro compensates copied traders through the Popular Investor Program.

- 🔸 Extensive Education: eToro provides an extensive trader education suite, empowering users with a deep understanding of trading concepts and strategies.

- 🔸 User Control: Traders have control over the selection process based on clear metrics, which can be adjusted as needed, offering flexibility and customization.

🔽 Cons:

- 🔹 Leverage Caps: Leverage on eToro is often capped at lower levels compared to other brokers, impacting trading strategies for some traders.

- 🔹 Past Performance No Guarantee: Past performance does not guarantee future success in trading, highlighting the need for continuous assessment and adaptation.

🌐 Which Stock Signals Are Right for You?

Choosing between Tickeron’s AI trading stock signals and eToro’s CopyTrader stock signals hinges on your trading style, preferences, and objectives. Let’s explore the unique advantages of each:

📈 AI-Powered Stock Signals

▪️Precision and Automation: AI signals offer a level of precision and automation that is unmatched. They can analyze vast datasets and patterns within seconds, providing traders with timely and data-driven insights.

▪️Data-Driven Decisions: AI signals are rooted in statistical analysis and historical data. This helps traders make decisions based on quantifiable patterns and reduces emotional biases that human traders may experience.

▪️Continuous Learning: AI algorithms constantly learn from market behavior, adapting and improving their strategies over time. This adaptability can be a significant advantage in rapidly changing markets.

👤 Human Expert Trader’s Copy Trading Stock Signals

▪️Human Insight: Copying signals from human experts allows traders to benefit from the experience and intuition of seasoned professionals. Human traders can factor in qualitative information that AI may struggle to interpret.

▪️Mentorship: Copy trading signals from expert traders can be an educational experience. It allows traders to learn from the strategies and decision-making processes of successful individuals.

▪️Community and Social Interaction: Human-led copy trading often occurs within a community of traders. Traders can interact, share insights, and build connections, fostering a sense of belonging and collaboration.

🤔 How These Differences Align with Trader Styles and Strategies

🔹 Day Traders

Day traders who require quick, data-driven decisions may find AI signals more suitable. The speed and precision of AI can align well with their rapid trading style.

🔹 Long-Term Investors

Investors with a long-term perspective may prefer human expert trader signals. They can benefit from insights that consider broader market trends and economic factors.

🔹 Social Traders

Traders who value community and interaction may lean towards human expert trader copy trading. It allows them to connect with like-minded individuals and learn from each other.

🔹 Adaptive Traders

Traders who frequently adjust their strategies based on market conditions may find AI signals beneficial. AI can quickly adapt to changing data and provide real-time insights.

🔹 Portfolio Diversifiers

Those looking to diversify their portfolios might explore both AI and human signals. They can use AI for data-driven decision-making and human signals for qualitative insights.

In the dynamic world of trading, the choice between AI signals and human expert trader copy trading signals ultimately depends on a trader’s objectives, trading style, and the assets they’re dealing with. Some traders may even choose to combine both approaches, leveraging the strengths of each to optimize their strategies and increase their chances of success.

🌐 Understanding Stock Signals

Stock signals are powerful tools that can significantly enhance your trading and investment strategies. Whether you’re a seasoned trader or a novice investor, stock signals offer a systematic, data-driven approach to navigating the complex world of the stock market. By leveraging the benefits of stock signals, you can make more informed decisions, manage risk effectively, and work towards achieving your financial goals with confidence.

🟢 Benefits of Using Stock Signals

Stock signals offer a multitude of benefits to investors, making them indispensable tools in the world of trading:

✅ Access to More Profitable Opportunities

Stock signals bring a wealth of trading opportunities to the table. Some of these opportunities may have remained undiscovered by investors themselves. This abundance of choices empowers investors to select the most suitable trades that align with their specific trading goals.

✅ Empowerment and Control

Stock signal users maintain control over their investments. This autonomy is a distinct advantage compared to other investment options, as it allows investors to make informed decisions based on the signals they receive.

✅ Stress Reduction

With reliable stock signals, the level of risk is mitigated, and the potential for profit is enhanced. This newfound confidence allows investors to engage in trading with reduced stress and anxiety.

✅ Time and Money Savings

Following stock signals saves investors valuable time, money, and resources. The arduous process of research and analysis is bypassed, and not only is time and money saved, but the capital at risk of losses is also preserved.

✅ Improved Profit Potential

Stock signals are grounded in rigorous analysis and research. Consequently, the probability of making profits is significantly higher when trading based on these signals.

✅ Increased Trading Opportunities

Signal providers regularly issue trade signals, opening the door to a higher volume of trading activities. Investors can take advantage of these signals to execute a greater number of trades.

🔴 Disadvantages of Using Stock Signals

Despite their many advantages, stock signals do come with some drawbacks:

🔻 Authenticity Concerns

Investors who receive stock signals may not know the individuals or organizations behind the signals. This lack of transparency can raise concerns about the authenticity and accuracy of the signals. To mitigate this risk, it is advisable to keep detailed records of transactions and outcomes.

🔻 Costs Involved

While free stock signals are available, they often lack the depth and reliability of paid services. Investors must be prepared to incur costs when subscribing to reputable signal providers.

🔻 Learning Compromise

Investors who heavily rely on stock signals may miss out on the opportunity to truly understand how the stock market operates and what drives price fluctuations. Learning can take a backseat when using stock signals. To address this, investors should seek out signal providers who offer educational resources and market insights to foster a deeper understanding.

🌐 What To Look For In A Stock Signals Provider?

In a market brimming with signal providers, choosing the right one can be as crucial as the trades themselves. These providers come in various flavors, each with its unique focus, whether it’s day trading or long-term investment. Here’s what you should consider when seeking a stock signal provider:

🔍 Proven Track Record

The foremost characteristic of a trustworthy signal provider is a track record of consistently outperforming the market. While no provider can guarantee 100% accuracy, a high success rate enhances their credibility. Look for a provider with a longer history of delivering accurate signals; this can boost your confidence in their abilities.

🔍 Transparency

Transparency is the bedrock of trust in the world of stock signals. A reputable provider should openly record both their winning and losing trades. Concealing losses or showcasing only victories is not only misleading but also unethical. To gauge a provider’s credibility, take advantage of free trial periods and money-back guarantees when available. This allows you to assess the service firsthand before committing your hard-earned money.

🔍 Alignment with Your Goals

Not all signal providers are created equal. Before diving in, study the provider’s strategy and data analysis techniques to understand their methodology. Make sure their approach aligns with your investment goals and expectations. Whether you’re seeking quick day trading opportunities or long-term investments, choose a provider whose signals resonate with your strategy to avoid future disappointments.

Remember that selecting the right signal provider can make a significant difference in your trading success. Take the time to research and evaluate your options, considering their track record, transparency, and alignment with your investment goals. By choosing wisely, you can leverage the power of stock signals to enhance your trading journey.

🏹 For The Success Of Your Trading

As we delve deeper into the world of stock technical analysis, having access to reliable and comprehensive tools becomes paramount for making informed trading decisions. In my daily trading, I rely on TradingView, an exceptional platform for stock chart analysis.

TradingView offers a plethora of features and tools that empower traders and investors to conduct thorough chart analysis. To explore the benefits of TradingView, take a look my comprehensive review in the article “How TradingView Can Change the Game for Traders” You can also access the platform directly here.

🍵 Conclusion

In this comprehensive exploration of stock signals, we’ve compared two prominent providers: Tickeron’s AI Trading Signals and eToro’s Copy Trading Signals. Each offers unique strengths catering to different trading preferences and goals.

Whether you prefer the data-driven precision of AI-driven signals or the social power of copying expert traders, the choice ultimately depends on your trading style and objectives. What remains constant is the importance of understanding the signals you use and the need for continuous learning and adaptation in the ever-evolving world of stock trading.

By harnessing the power of stock signals, you can navigate the complex stock market with confidence, make informed decisions, and work towards achieving your financial goals. Remember, the right signals can be a valuable ally on your trading journey, but the mastery of market knowledge and strategy is equally vital for sustained success.

🌿 FAQ

Q1: What are stock signals, and how do they work?

Stock signals are data-driven indicators or recommendations that provide insights into potential trading opportunities. They analyze various factors, such as technical and fundamental data, to guide traders in making buy or sell decisions. These signals can be generated by algorithms, experienced traders, or platforms like Tickeron and eToro.

Q2: Are stock signals reliable?

The reliability of stock signals varies depending on the source and methodology. Signals from reputable providers with a proven track record tend to be more reliable. However, no signal can guarantee 100% accuracy, and traders should use signals as part of a broader trading strategy.

Q3: Are there risks associated with using stock signals?

Yes, there are risks involved in using stock signals. One risk is the potential for signals to be inaccurate, leading to trading losses. Additionally, relying solely on signals without understanding market dynamics can hinder your ability to adapt to changing conditions.

Q4: Can I use both Tickeron and eToro simultaneously?

Yes, you can use both Tickeron and eToro simultaneously if it aligns with your trading strategy. Some traders may choose to diversify their portfolio by incorporating signals from multiple sources.

Q5: How can I choose the right stock signal provider for my needs?

Choosing the right signal provider involves assessing their track record, transparency, and alignment with your trading goals. Look for providers that offer trial periods or money-back guarantees to test their service before committing.

Q6: Can stock signals guarantee profits?

No, stock signals cannot guarantee profits. While they can provide valuable insights, trading always involves risk, and there are no guarantees in the stock market. It’s essential to use signals as one tool among many in your trading toolkit and to manage risk effectively.

Q7: What is the importance of aligning a stock signal provider with my goals?

Aligning a stock signal provider with your goals ensures that the signals you receive are relevant to your trading strategy. Different providers may focus on specific markets or trading styles, so choosing one that matches your objectives can enhance your trading experience.

Q8: Is there a recommended starting point for traders new to stock signals?

For traders new to stock signals, it’s advisable to start with a provider that offers educational resources and a user-friendly interface. This can help you learn how to interpret signals and make informed decisions as you gain experience in the world of trading.

Remember that stock signals are valuable tools, but they should be used in conjunction with your understanding of the market and your individual trading goals. Continuous learning and adaptation are key to long-term success in trading.

Q9: Where can I find information about Forex signals?

If you’re interested in Forex signals, you can check out our earlier article on the topic: “Compare 3 Top Forex Trading Signals“. This article provides a comprehensive reviews of 3 Top Forex trading signals providers and can help you understand how they work in the foreign exchange market.

Q10. How can I learn more about stock technical analysis?

To dive deeper into technical analysis, consider enrolling in online courses or reading books on the subject. There are also numerous YouTube channels and forums where traders share their insights.

Additionally, if you’re looking for a comprehensive online trading course, I recommend checking out StockOdds. They offer a range of educational resources and insights that can help you sharpen your technical analysis skills.

👉👉 Connect with Me: Instagram and StockTwits ✌️