In the dynamic world of the stock market, where opportunities and risks often go hand in hand, “gap up stocks” have emerged as a thrilling yet potentially perilous phenomenon.

Gap up stocks are stocks whose opening prices significantly exceed their previous closing prices, creating a noticeable gap on the price chart.

In this article, we delve into the intricacies of trading gap up stocks, offering valuable insights into key trading strategies and indispensable trading tips.

✏️ Table of Contents

🌐 Understanding the Gap Up Stocks Phenomenon

Gap up stocks come into play when a stock’s opening price is significantly higher than its prior closing price, resulting in a conspicuous gap on the price chart. This occurrence can be alluring and risky in equal measure.

Sometimes, significant news, such as a corporate merger or robust financial results, breaks overnight, igniting a buying frenzy that propels stock prices to open with a substantial gap up.

However, jumping hastily into these opportunities due to the fear of missing out can be perilous. As profit-taking and other forms of selling commence, stock prices often retrace back to the initial opening level. This is where the concept of gap filling comes into play – a widely accepted principle among traders that posits these open gaps are eventually filled.

To mitigate the risk of entering the market at an inflated price, keenly observing price movements after a gap appears becomes an effective risk management tool.

🌐 Biotech Stocks and Gap Trading: A Risky Venture

While gap-ups are a common occurrence when significant news hits the market overnight, navigating these gaps can be particularly precarious in the realm of biotech stocks.

Biotech stocks are notorious for their susceptibility to extreme price volatility, especially in response to significant events like FDA approvals or clinical trial results. These events can lead to substantial price gaps, sometimes as high as 100% the following day, presenting both opportunities and challenges for traders.

When a significant gap up occurs, investors and traders are often eager to jump on the bandwagon, hoping for potential gains. However, a more cautious approach is advisable.

Common reversal scenarios following a significant gap up include:

🔻 Gap Up to Resistance:

The opening price surges until it encounters significant resistance. It then tends to hover around this resistance, often resulting in a Doji candlestick—a sign of indecision in the market.

🔻 Bounced by Resistance:

The stock initially gaps up but faces resistance, followed by a sharp drop in price. This rollercoaster ride can be painful for traders who bought in at the initial gap-up.

🔻 Vigorous Rise Followed by Reversal:

Some gaps exhibit an initial substantial price increase, followed by continued bullish momentum. However, when resistance is met, a sudden reversal occurs, marked by an inverted hammer candlestick with a long upper wick. This pattern can be particularly challenging to navigate.

In such cases, investors who have held the stock from the previous day may profit significantly. In contrast, those who hastily enter the market when prices surge in the morning, even on days of substantial gains, often find themselves on the losing side. Furthermore, those who enter the market near resistance levels and get caught in the abrupt drop experience substantial losses.

🌐 Why Gap Filling Occurs

Gaps tend to appear when significant news disrupts the market or when market conditions become overheated, leading to excessive buying (or selling) momentum in a single direction. When the material or momentum driving the market dissipates, the overheating subsides, prompting stock prices to revert to their original levels – a phenomenon referred to as “gap filling“.

Additionally, traders holding positions from the previous day often close them to secure profits when gaps occur. Traders facing substantial unrealized losses may also temporarily close their positions to minimize losses. These actions contribute to the market price moving counter to the gap’s initial direction, facilitating the filling of the open gap.

Moreover, traders who identify gaps may attempt to profit from them by engaging in short selling, further propelling the price toward gap closure. These dynamics create a high likelihood of gap filling.

In the midst of a gap’s upward surge, especially when the stock approaches resistance levels, experienced traders often choose to sell simultaneously, leading to a rapid decline in stock prices. Panic-stricken traders subsequently sell, causing the stock price to plummet.

When experiencing a substantial price jump due to a gap up, it is essential to secure your position and assess the situation while still ahead.

🌐 Understanding the Distinction Between Novice and Seasoned Traders

When it comes to trading gap up stocks, it’s crucial to grasp the fundamental difference in perspective between novice and seasoned traders.

Unlike novice traders who tend to buy stocks during upward trends, seasoned traders adopt a distinct approach. They actively seek opportunities to sell and lock in profits when prices experience significant increases.

In simpler terms, when a stock price undergoes a substantial surge, it’s essential to remain cognizant of the possibility that it may soon face selling pressure.

This seasoned approach to trading is deeply rooted in a comprehensive understanding of market dynamics and technical analysis.

If you’re interested in delving further into this mindset and strategy, I’ve covered it extensively in the article titled “How to Make Money in the Stock Market with 7 Essential Trading Mindsets | A Tale of the Shoeshine Boy“. It provides valuable insights into the mindset of successful traders.

🌐 2 Key Aspects for Gap Up Stocks Trading Strategy

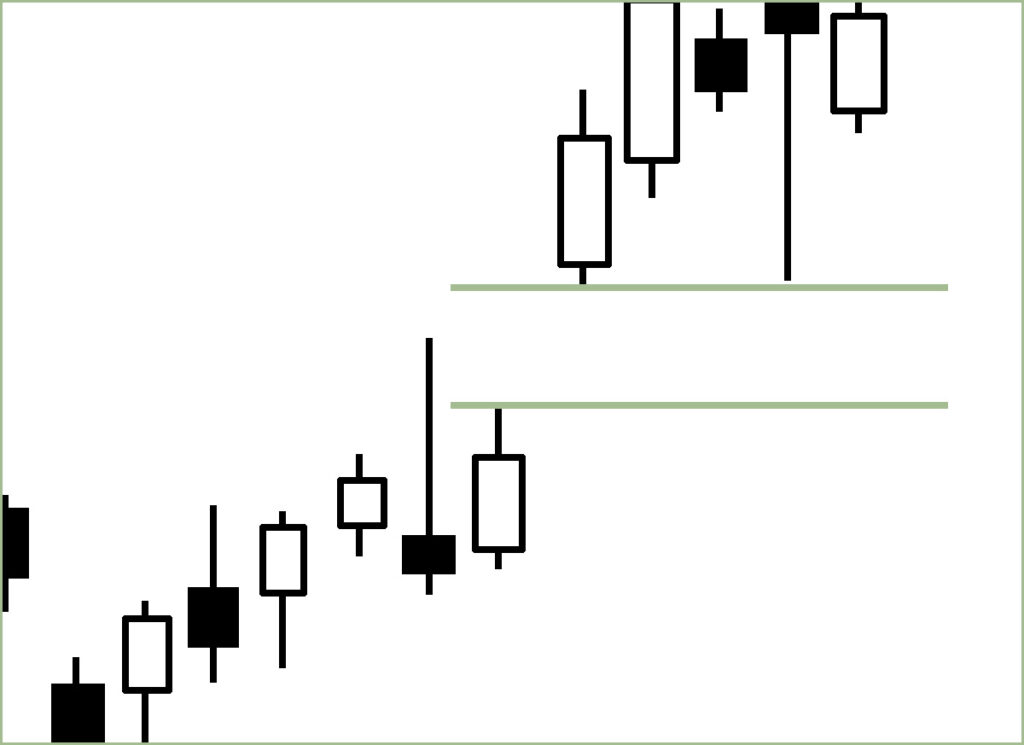

💡 Utilizing Gap Levels as Pivotal Support and Resistance

In a typical market trend, the levels where a gap begins and ends can serve as vital support or resistance levels in the future. This observation forms the basis of a useful gap up stocks trading strategy.

Stocks that have successfully filled a gap following a significant gap up, often triggered by temporary news, tend to exhibit a particular pattern. After filling the gap, there is a likelihood that these stocks will find support at that level and then rebound or bounce upward, which is a common price behavior. It’s widely acknowledged that when stock prices enter a rising trend following a filled gap, it can result in a more stable, long-term upward market, making it a preferable scenario for investors rather than an unfilled gap case.

In certain situations, such as when investors have missed out on a stock due to significant events or prefer not to hastily buy at an elevated price following material announcements, one effective strategy is to exercise patience and await the gap’s filling. This approach enables you to enter the market at a more favorable price point.

💡 The Vital Role of Observation in Gap Trading

However, it’s crucial to recognize that the timeline for filling the gap, whether on the same day or even a year later when prices fall once again, hinges on various factors.

Some gaps stemming from temporary news tend to close swiftly, while others, occurring during robust price movements with steadily accumulating buying pressure, may lead to other investors following the trend. Consequently, stock prices may continue in that direction in the short term. In such circumstances, vigilance becomes essential when identifying a potential change in trend, especially during an exhaustion gap. An exhaustion gap represents a significant price jump as the market opens, signaling the final stage of an uptrend.

Furthermore, when examining long-term charts and the stock price is continuously declining, it’s a good idea to check if there were any gaps in past charts. If the stock price comes down to the vicinity of that gap, pay close attention, as you may find a strategic entry point. As mentioned earlier, gaps create support and resistance levels, and stock prices may reverse after filling the gap or from the upper price level of the gap.

🌐 Exploring Gap Types: From Common Gap to Exhaustion Gap

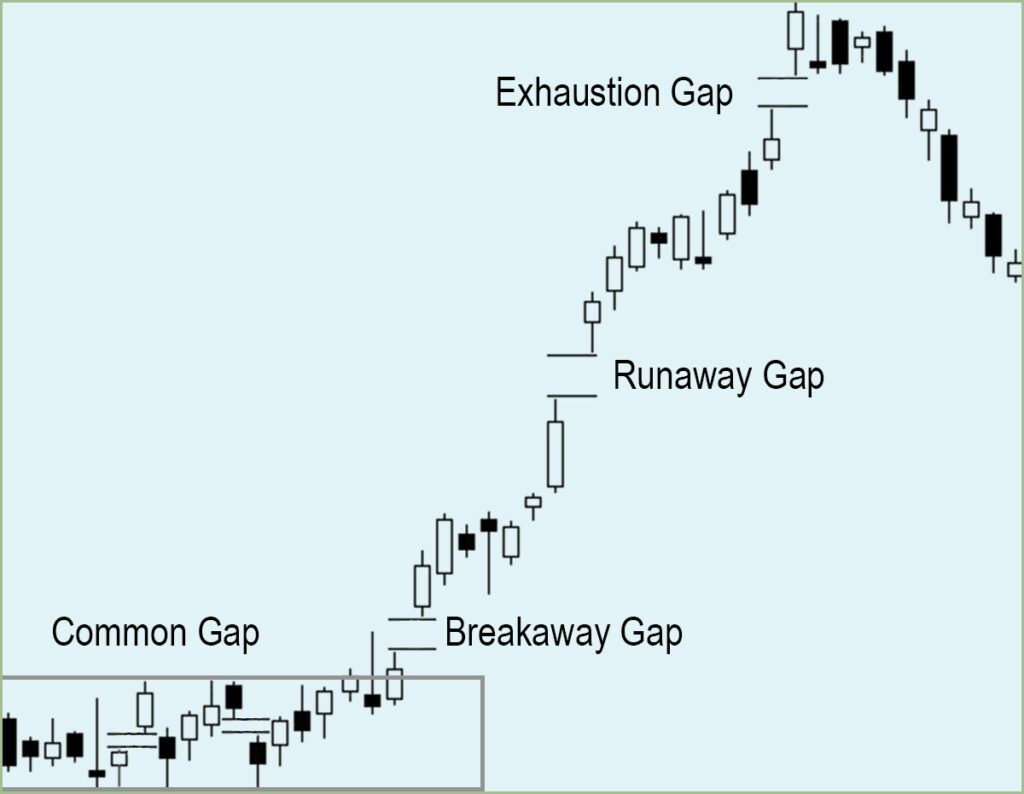

Gap up stocks can be categorized into four primary types, each with its own characteristics and implications:

🏓 Common Gap

This type manifests during a consolidation phase and is often quickly filled. It doesn’t carry much significance for the overall trend and is frequently observed in stocks with thin trading volumes.

⏰ Breakaway Gap

Signifying the potential for a change in trend, this gap occurs when the price breaks out of the previous price range and advances to a new level. It requires underlying factors for its occurrence, and the possibility of gap filling depends on the strength of these factors.

🏇 Runaway Gap

Occurring in the middle of the market after Common Gap Ups or Break Gap Ups, the Runaway Gap Up signifies an acceleration in the trend. However, it can sometimes shorten the lifespan of the market due to the depletion of energy.

🪫 Exhaustion Gap

This gap occurs at the end of the market and indicates the exhaustion of energy. It’s a time for profit-taking and is a crucial consideration when stock prices reach considerably high points.

🌐 Trading Strategies and Tips

In summary, gap up stocks offer both opportunities and risks in the trading world. Whether dealing with gap up or gap down scenarios, it’s crucial to analyze the factors behind the gap’s formation and exercise patience before entering the market.

Here are some essential trading strategies and tips:

1️⃣ Observe and Wait

After a gap up, resist the urge to jump into the market immediately. Instead, observe the price movements and look for signs that the gap might start to close. This cautious approach is crucial for risk management.

2️⃣ Biotech Stocks

Be especially cautious when dealing with biotech stocks, as they can be prone to high-risk gaps, often driven by events like drug approvals. Biotech gaps can lead to substantial price swings and require careful analysis.

3️⃣ Support and Resistance Levels

Gap levels can serve as support or resistance levels in the future. Stocks that have successfully filled a gap may enter a more stable upward trend, making these levels potential buy or sell points.

4️⃣ Don’t Chase the Market

Avoid impulsively buying when stock prices rise. Seasoned traders look for opportunities to sell when prices rise.

5️⃣ Exit Strategy

Have a clear exit strategy when trading gap up stocks. Decide when you’ll take profits and stick to your plan.

6️⃣ Long-Term Trends

Consider waiting for a pullback and gap filling when you’ve missed an opportunity or don’t want to buy at a high price immediately after significant news.

7️⃣ Monitoring the Trend

Keep an eye on long-term charts for signs of gaps, as they can create potential entry or exit points when the stock price approaches the gap level.

8️⃣ Loss-Cutting Measures

In cases of unexpected price movements, executing appropriate loss-cutting measures is imperative.

🏹 For Sharpening Your Trading Skills

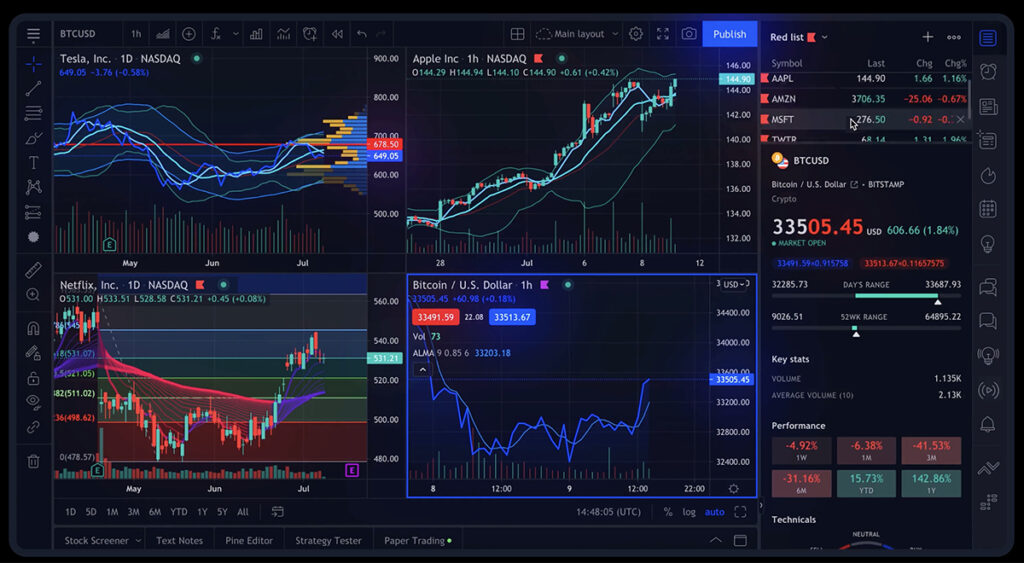

As we delve deeper into the world of stock market technical analysis, having access to reliable and comprehensive tools becomes paramount for making informed trading decisions. In my daily trading, I rely on TradingView, an exceptional platform for stock chart analysis.

TradingView offers a plethora of features and tools that empower traders and investors to conduct in-depth chart analysis for your stock trading strategy. To explore the benefits of TradingView, take a look my comprehensive review in the article “How TradingView Can Change the Game for Traders” You can also access the platform directly here.

🍵 Conclusion

In conclusion, gap up stocks are a captivating facet of the trading world, offering both opportunities and risks. Understanding the nuances of gap types and implementing effective strategies and risk management techniques can help traders navigate this volatile terrain successfully.

Remember, patience, and careful analysis are key when dealing with gap up stocks, and a well-thought-out trading plan can make all the difference in achieving success in the stock market.

🌿 Frequently Asked Questions (FAQ)

Q1. What are gap up stocks?

Gap up stocks are stocks that open at a significantly higher price than their previous day’s closing price, creating a visible gap on the price chart. This phenomenon often occurs due to significant news or events affecting the stock.

Q2. What is the significance of gap filling in trading?

Gap filling refers to the process where a gap on a price chart is eventually filled as the stock’s price returns to its original level. Understanding gap filling is crucial for traders as it can help them make informed decisions and manage risk when trading gap up stocks.

Q3. How do I identify different types of gaps in stock charts?

To identify different types of gaps, you can analyze the price chart and look for specific patterns and characteristics. Common gaps, break gaps, runaway gaps, and exhaustion gaps each have distinct features that can be recognized through technical analysis.

Q4. Are gap up stocks riskier in certain industries, such as biotech?

Yes, gap up stocks can be riskier in industries like biotech, where significant news events like FDA approvals or clinical trial results can lead to extreme price volatility. Traders should exercise caution and conduct thorough research in such cases.

Q5. What are some key trading strategies for gap up stocks?

Some key trading strategies for gap up stocks include observing and waiting for signs of gap closure, considering support and resistance levels, avoiding chasing the market, and having a clear exit strategy. These strategies can help traders manage risk and maximize potential profits.

Q6. How can I develop a successful trading plan for gap up stocks?

Developing a successful trading plan for gap up stocks involves a combination of technical analysis, risk management, and discipline. Traders should set clear entry and exit points, define their risk tolerance, and stay updated on market trends and news.

Q7. Is trading gap up stocks suitable for beginners?

Trading gap up stocks can be challenging and carries inherent risks, making it more suitable for experienced traders. Beginners are advised to gain a thorough understanding of stock market dynamics and practice trading in less volatile conditions before venturing into gap up stocks.

Q8. What should I do if I encounter unexpected price movements while trading gap up stocks?

In cases of unexpected price movements, it is imperative to execute appropriate loss-cutting measures. Traders should stick to their predetermined exit strategies and avoid emotional decision-making to protect their capital.

Q9. Where can I find more resources to improve my trading skills?

To enhance your trading skills, consider reading books on technical analysis, attending trading seminars or webinars, and following reputable financial news sources. There are also numerous YouTube channels and forums where traders share their insights.

Additionally, if you’re looking for a comprehensive online trading course, I recommend checking out StockOdds. They offer a range of educational resources and insights that can help you sharpen your technical analysis skills.

Q10. Where can I access real-time stock charts?

For real-time stock charts, check out TradingView, which is what I’m using. It’s the best online trading platform, offering a comprehensive toolkit to traders!

👉👉 Connect with Me: Facebook and StockTwits ✌️