In the realm of trading strategy and investing, there’s an old Japanese saying that goes, “頭と尻尾はくれてやれ” which translates to “Give away fish head and tail and eat only the body part.”

This proverb holds a valuable lesson for traders, emphasizing the importance of a prudent trading strategy that focuses on the central portion of a price trend.

In this blog post, we’ll delve into this intriguing trading strategy, exploring why it stands as a safer and more prudent approach in navigating the volatile world of financial markets.

✏️ Table of Contents

🏹 The Essence of the Trading Strategy

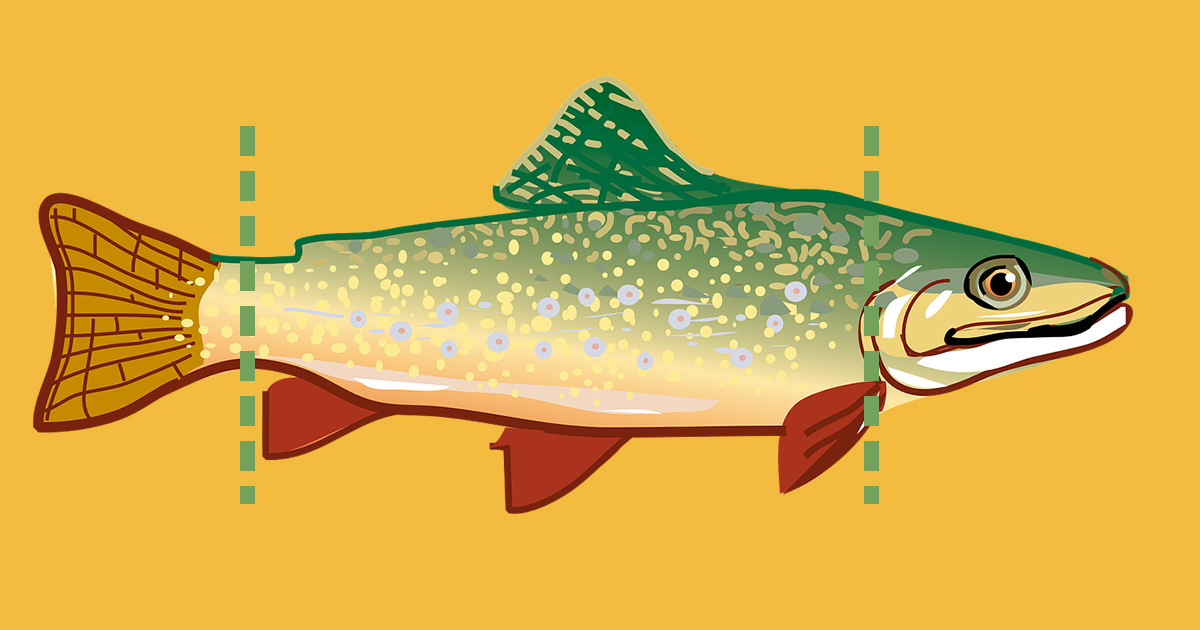

The Japanese trading strategy of “eating only the body of the fish” essentially advises traders to focus on the central portion of a price trend, while avoiding the turbulent beginnings and endings.

Let’s break down the key components of this strategy.

✋ Avoiding the Head (Initial Phase)

Just as you wouldn’t consume the head of a fish, which contains many bones and less meat, traders are encouraged to steer clear of the initial stages of a stock’s upward movement. In trading terms, this means avoiding chasing after a stock right at the beginning of its upward trend, when it has just lifted its head and is turning direction.

✋ Skipping the Tail (Final Phase)

Similarly, just as the tail of a fish often offers less meat and presents challenges in extracting value, traders are advised to exit their positions before a trend exhausts itself completely. The aim is to secure profits while the stock still has room to run, avoiding the pitfall of a sudden reversal driven by greed.

👍 Focusing on the Body (Secure Price Zone)

The crux of this strategy lies in focusing on the stable, middle segment of a price trend. In this zone, traders discover a relatively secure environment for entering or exiting a trade. This approach minimizes the inherent risks tied to chasing momentum or stubbornly clutching onto positions for too long.

🏮 Japanese Pioneers in Trading

Japan has a rich history of contributing to the field of trading and technical analysis. Two notable Japanese innovations that have had a significant impact on trading worldwide are:

▪️Candlestick Charts

The genesis of candlestick charts can be traced back to Japan, crafted in the 18th century by Munehisa Homma, a Japanese rice trader. These charts offer a vivid depiction of price movements over a specified timeframe.

Each candlestick displays the opening, closing, high, and low prices for that period. Traders employ candlestick patterns to discern potential trend reversals or continuations, rendering them a pivotal asset in technical analysis.

▪️Ichimoku Cloud Chart

Emerging in the mid-20th century, the Ichimoku Cloud chart—conceived by Japanese journalist Goichi Hosoda—introduces a multifaceted charting system.

This intricate system incorporates multiple lines and a cloud element to provide a comprehensive view of support, resistance, and trend direction. Traders employ the Ichimoku Cloud to gauge market sentiment holistically, empowering them to make judicious trading decisions.

💡 The Wisdom of the Japanese Saying

The Japanese trading strategy of eating only the body of the fish encourages traders to exercise discipline, patience, and risk management.

By focusing on the core of a price trend, traders can:

- Minimize Risk:

By avoiding the head and tail of a trend,traders shield themselves from wild price gyrations. - Lock in Profits:

Exiting positions at an appropriate time helps secure gains and prevents potential losses. - Maintain Emotional Control:

This trading strategy discourages impulsive actions driven by fear or greed, fostering a steadier mindset.

🍵 Conclusion

In the dynamic world of trading, the Japanese have left a treasure trove of innovations, including candlestick charts and the Ichimoku Cloud chart. These invaluable tools, along with the timeless adage “Give away fish head and tail and eat only the body part,” impart essential lessons in discipline and risk management.

While the allure of chasing extreme price movements may be tempting, such a path often leads to heightened vulnerability and potential losses. By adopting a trading strategy that focuses on the stable middle portion of a price trend, traders can enjoy a more balanced and sustainable approach to trading. It’s a reminder that trading wisely and safeguarding capital are paramount in the unpredictable realm of financial markets.

🔔 For Sharpening Your Trading Skills

In the realm of stock analysis, having access to reliable and comprehensive tools is crucial for making informed trading decisions.

If you are serious about improving your trading skills, exploring the right tools is essential. TradingView stands out as one of the most powerful platforms available.

TradingView is one of the best trading platforms, known for its outstanding charts and abundant tools that help traders sharpen their skills. With features like real-time data, advanced screeners, strategy testing, social insights, and custom alerts, it is a complete toolkit for traders of all levels.

If you want to explore the capabilities of TradingView further, check out my comprehensive review in this article:

“7 Powerful Key Features of the Best Trading Chart Platform: TradingView.“

👉👉 Connect with Me: Facebook and StockTwits ✌️