Welcome to our trading beginners guide, where you’ll embark on a journey to learn stock market investing and master the art of financial empowerment and growth.

The stock market, often viewed as the beating heart of the global economy, offers a world of opportunities for those who seek financial empowerment and growth. In this comprehensive guide, we will walk you through the essential steps to get started in the world of stock market investing and help you learn stock market investing from the ground up. From understanding the basics to mastering advanced techniques, you’ll gain the knowledge and confidence to make informed investment decisions.

Let’s begin your journey of discovery and empowerment in the exciting realm of stock market investing.

✏️ Table of Contents

🌐 Step 1: Determine Your Investing Approach

🌱 Self-Assessment for Investor Archetypes

Before you dive into the stock market, it’s crucial to define your investing approach and learn stock market investing. Ask yourself what type of investor you want to be:

1️⃣ The Analyzer:

If you enjoy crunching numbers and doing in-depth research, investing in individual stocks might be your best fit.

2️⃣ The Research Enthusiast:

If you love reading about different companies but aren’t keen on complex math, a more passive approach, like index funds, could be your ticket.

3️⃣ The Time-Strapped Professional:

If you’re busy and don’t have the time for in-depth stock analysis, consider using a robo-advisor to manage your investments automatically.

🔍 Investment Pathways

Adding to the type of investor, there is a range of stock market investment options:

🔸 Investing in Individual Stocks

This approach involves in-depth research and ongoing evaluation. It’s suitable for those willing to dedicate time and effort. Smart and patient investors can potentially outperform the market. However, it requires regular attention to quarterly reports and some mathematical analysis.

🔸 Investing in Index Funds

Index funds track stock indices, like the S&P 500. They offer diversification and generally have lower costs compared to actively managed funds. They are designed to closely match the long-term performance of their underlying indices, making them a reliable choice for wealth accumulation.

🔸 Using Robo-Advisors

Robo-advisors, a popular choice, automate your investments in a portfolio of index funds tailored to your age, risk tolerance, and goals. They not only select investments but also optimize tax efficiency and make adjustments automatically. Robo-advisors are ideal for those seeking a hands-off approach to investing.

In essence, your selection of an investing approach hinges on your personal preferences, the time you can commit, and your risk tolerance. Whether you lean towards individual stocks, favor the simplicity of index funds, or opt for the convenience of robo-advisors, there’s a tailored path to stock market investing that harmonizes with your financial goals and lifestyle..

🌐 Step 2: Set Your Stock Investment Amount

Stock market investments come with risk, so it’s crucial to allocate only the money you won’t need for at least the next five years. Asset allocation, which takes into account factors like age, risk tolerance, and investment objectives, plays a pivotal role in deciding how much to invest in stocks.

A quick rule of thumb is to subtract your age from 110. This gives you the percentage of your investable money that should be in stocks, with the rest in fixed-income investments. Adjust this ratio based on your risk tolerance and financial goals.

🌐 Step 3: Decide Where to Open a Brokerage Account

When it comes to embarking on your stock market journey, selecting the right gateway is paramount. Here are your options:

🔸 Full-Service Broker

Think of a full-service broker as your seasoned mountain guide. They offer a comprehensive range of services, providing investment advice, stock recommendations, and access to exclusive opportunities like initial public offerings. However, this level of expertise comes at a price – you’ll be paying commissions and fees.

Well-known full-service brokers include names like Merrill Lynch, Morgan Stanley, and Goldman Sachs.

🔸 Discount Broker

Now, envision yourself as the captain of your ship, navigating the stock market’s waters. Discount brokers provide fewer services compared to full-service brokers. They won’t give you personalized investment advice, but they will execute trades for you, often for a modest fee. If you’re feeling adventurous, you can take control and make your own trades through their user-friendly online platforms. Plus, you’ll usually find lower fees here, and sometimes even opportunities for commission-free trading.

Fidelity and Schwab stand out as prominent discount brokers. Don’t forget Robinhood, with its popular mobile app, offering fee-free account openings and minimal trade requirements.

🔸 Robo-Advisor

The robo-advisor’s like having a smart sidekick who does the work for you. The process starts online, with the robo-advisor asking you questions about your budget, investment goals, and how often you want to invest. Once your account is set up, it takes over, selecting and managing a portfolio of stocks on your behalf, following your investment schedule.

Some discount brokers, such as Fidelity and Schwab, have ventured into the robo-advisor arena. You’ll also find standalone robo-advisors like Betterment and Acorns.

🌐 Step 4: Opening a Brokerage Account

Now that you’ve decided which path suits you best, it’s time to open your gateway to the stock market. Think of it like opening a regular bank account – it’s easy and straightforward.

▪️For Full-Service Brokers

Schedule a meeting with an advisor in person. They’ll walk you through different account options and help you choose what’s right for your goals.

▪️For Online Brokerage Accounts

Visit the broker’s website and fill out an online application. You’ll need to provide some personal info, like your name, Social Security number, driver’s license or passport details, employment status, and contact info. They might also ask for additional financial information, like your bank name and account number.

Before you pick a specific broker, remember these two things:

✅ Account Type:

Decide whether you need a standard brokerage account or an Individual Retirement Account (IRA). If you want easy access to your money or are investing for a rainy day, a standard account might be best. But if you’re planning for retirement, an IRA has tax benefits, although it’s a bit trickier to access your funds.

✅ Compare Costs and Features:

While many online brokers have done away with trading commissions, they’re not all the same. Some offer educational tools and research, ideal for beginners, while others provide access to foreign stock markets. The broker’s trading platform should also be user-friendly and functional. If possible, try out a demo version before you commit any money.

🌐 Step 5: Decide How to Invest in Stocks or Stock Funds

🔍 Exploring the Stock Exchanges

Before you dive into the world of stock investing, it’s essential to understand where stocks are traded. Think of these stock exchanges as the grand marketplaces where stocks of various companies are bought and sold. Here are some notable examples:

▪️ New York Stock Exchange (NYSE)

The NYSE is like the bustling main street of stock exchanges, one of the largest and most renowned globally. Located in New York City, it’s a hub where companies from around the world aim to have their stocks listed. Some of the biggest and oldest companies, such as Coca-Cola, McDonald’s, and Walmart, call the NYSE home.

▪️ Nasdaq

Unlike the New York Stock Exchange (NYSE), Nasdaq conducts all its trading electronically and doesn’t have a physical trading floor. It’s known for listing numerous tech giants like Apple, Amazon, and Google. Nasdaq functions like a specialized online marketplace for technology stocks.

▪️ London Stock Exchange (LSE)

The LSE weaves a tapestry of global commerce and financial history. Nestled in the United Kingdom, it not only showcases British stocks but also welcomes companies from across Europe and beyond. It’s a marketplace where diverse businesses find their place, contributing to a rich and intricate financial mosaic.

▪️ Hong Kong Exchanges and Clearing Limited (HKEX)

HKEX stands as Asia’s largest stock market and hosts numerous Chinese companies. This exchange plays a pivotal role in East Asia and facilitates trading in stocks, bonds, commodities, derivatives, and more.

Picture these stock exchanges as unique realms, each possessing its own character and offerings. The NYSE resembles a bustling metropolis with a diverse array of stores (companies), while Nasdaq is the digital epicenter specializing in cutting-edge tech products. Your choice of ‘shopping center’ depends on where the company’s shares are traded.

🔍 Navigating Stock Investment Choices

Now, let’s embark on a journey through the various avenues of stock investing, exploring the three distinct styles you should be aware of when deciding how to put your money to work.

❇️ Individual Stocks: Precision and Control

Investing in individual stocks empowers you as the architect of your portfolio. You select specific publicly traded companies, decide the number of shares to own, and even explore fractional shares if needed. This approach offers growth potential but carries inherent market risks, so invest wisely.

❇️ Mutual Funds: Collective Diversification

Mutual funds pool investments from many, creating diversified portfolios. They’re professionally managed and accessible through various brokers. Types include actively managed, index funds, and target-date funds. While offering diversity, they come with management fees and aren’t as instantly tradable as stocks.

❇️ Exchange-Traded Funds (ETFs): Blend of Both

ETFs blend individual stock flexibility with mutual fund diversification. Like stocks, they trade throughout the day, allowing for fractional shares. ETFs offer diversification and liquidity, appealing to a wide range of investors with low entry points.

With these options in mind, you can make informed choices about how to invest your money that align with your financial goals and risk tolerance.

🌐 Step 6: Pick Your Stocks

OK, next, it’s time to pick the stocks. When it comes to selecting individual stocks for your portfolio, there are several important factors to consider. Let’s start with understanding the basics:

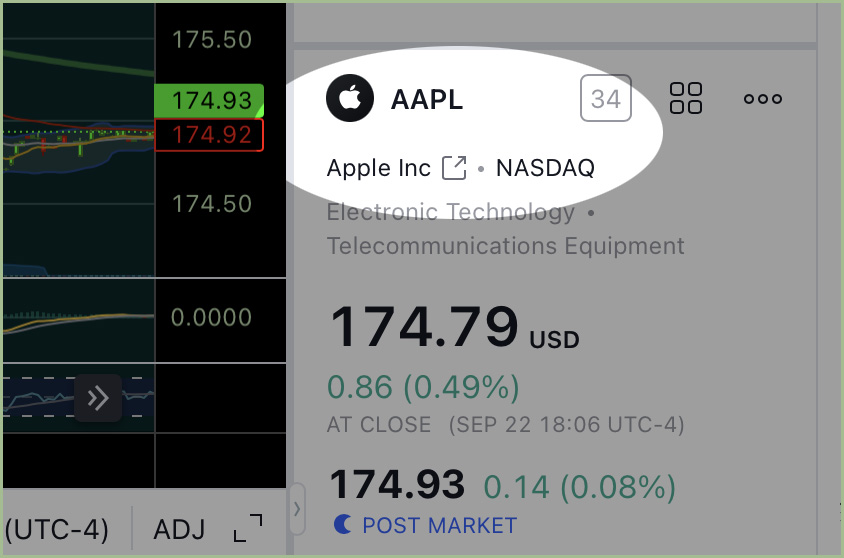

🔘 Ticker Symbol

So, you may have seen that stocks are traded with a unique code. That code is called a ticker symbol. But what exactly is a ticker symbol.

Every publicly traded company has a ticker symbol, which is a unique series of letters assigned for trading purposes. Stocks listed on the New York Stock Exchange (NYSE) often have ticker symbols with four or fewer letters, while Nasdaq-listed securities can have up to five characters.

💡 Tips for Stock Picking

Now, let’s delve into some valuable tips for beginners when selecting individual stocks for your investment portfolio:

☑️ Don’t Put All Your Eggs in One Basket

One of the fundamental principles to learn stock market investing is diversification. It’s a strategy that involves spreading your investments across a variety of assets, such as different stocks, bonds, or asset classes. By doing so, you reduce the risk associated with having all your investments concentrated in a single asset or a few assets. Diversification helps protect your portfolio from the poor performance of individual stocks or sectors.

☑️ Invest in What You Understand: Knowledge is Power

Warren Buffett, one of the most successful investors of all time, has a simple rule: “Never invest in a business you cannot understand.” Before buying a stock, it’s crucial to have a clear understanding of the company’s business model, industry, and competitive position. This knowledge empowers you to make informed investment decisions based on your understanding of how the company operates and generates revenue.

☑️ Avoid High-Volatility Stocks: Steady as She Goes

Stock market volatility can be unsettling, especially for beginners. Volatile stocks are prone to large price swings, which can lead to significant gains or losses in a short period. For novice investors, it’s often advisable to steer clear of high-volatility stocks until you become more experienced and comfortable with market dynamics. Instead, focus on more stable and established companies that tend to have smoother price movements.

☑️ Beware of Penny Stocks: Risky Business

Penny stocks are stocks of smaller companies usually valued at under $5 per share. While they may seem like an attractive entry point for new investors due to their low price, they come with substantial risks. Penny stocks are often associated with limited liquidity, higher volatility, and a lack of regulatory oversight. As a beginner, it’s wise to avoid penny stocks and prioritize investing in more established and reputable companies.

☑️ Start Small: Gaining Confidence

Investing is a learning process, and it’s perfectly okay to start small. Begin with an amount of money you’re comfortable with and gradually increase your investments as you gain more experience and confidence in your decision-making. Starting small allows you to learn stock market investing without taking on excessive risk.

☑️ Don’t Use Margin, Trade with Cash You Have

A critical rule for beginners is to avoid trading on margin. Margin involves borrowing money to buy stocks. While it can amplify gains, it also magnifies losses, potentially leading to substantial debts. It’s safer to trade with the cash you have, reducing the risk of financial pitfalls.

By considering these factors and following these tips, you can make informed choices when picking individual stocks for your portfolio, ultimately aligning your investments with your financial goals and risk tolerance.

🌐 Step 7: Placing Your Order

Now that you’ve selected the stocks you want to invest in, it’s time to understand how to place an order effectively. The stock market has its own unique lingo that you’ll need to familiarize yourself with. Let’s delve into the key terms and concepts that are essential for executing your trades:

▪️Market Order

A market order is like a green light to buy or sell a stock right away at the best available price in the market. It’s the fastest way to get in or out of a position. When you place a market order, you’re indicating that the timing of the trade is more crucial to you than the price. Keep in mind that market prices can fluctuate quickly, so you might not get the exact price you see when you enter the order.

▪️Stop Order (or Stop-Loss Order)

A stop order becomes active once a stock reaches a predetermined price known as the “stop price” or “stop level.” At that point, it automatically converts into a market order and is executed at the prevailing market price. Stop orders are often used as a risk management tool to limit potential losses. For instance, you can set a stop order to sell a stock if its price falls to a certain level, helping you protect your investment from further declines.

▪️Limit Order

A limit order allows you to establish a specific price threshold for buying or selling a stock. When you place a buy limit order, it means you are willing to purchase the stock at your set limit price or lower. Conversely, a sell limit order indicates your willingness to sell the stock at your designated limit price or higher.

▪️Stop-Limit Order

Similar to a stop order, a stop-limit order is triggered when the stock reaches a specified stop price. However, instead of converting into a market order, it turns into a limit order. With a stop-limit order, you set both the stop price and a limit price. Once the stop price is reached, the order is executed as a limit order within the price limits you’ve defined. This provides greater precision over the execution price but carries the risk of the order not being filled if the market doesn’t reach your limits.

▪️Ask (for Buyers): The Seller’s Price

The “ask” is the price at which sellers are willing to sell their stock. It represents the minimum amount a seller is willing to accept for a share of the stock. When you place a market order to buy, you’ll typically pay the ask price.

▪️Bid (for Sellers): The Buyer’s Price

Conversely, the “bid” is the price at which buyers are willing to purchase a stock. It reflects the maximum amount a buyer is willing to pay for a share. If you’re selling, you’ll generally receive the bid price for your shares when executing a market order.

▪️Spread: The Gap Between Bid and Ask

The spread is the difference between the highest bid price (what buyers are willing to pay) and the lowest ask price (what sellers are asking). It’s essentially the cost of trading, representing the disparity in prices between buyers and sellers in the market. A narrower spread indicates a more liquid market, while a wider spread may result in higher trading costs.

Understanding these terms and order types will empower you to navigate the stock market effectively and execute your trades with confidence.

🌐 Step 8: Explore Different Trading Styles and Positions

Now, let’s delve into the diverse world of trading styles and positions within the stock market. Understanding these concepts is crucial for making well-informed investment decisions.

💻 Trading Styles: Navigating the Market’s Rhythms

Trading styles are strategies employed by traders and investors to capitalize on various market conditions. Here are three common trading styles:

🔹 Day Trading:

Day trading entails the purchase and sale of stocks within the same trading day. Day traders aim to profit from short-term price fluctuations and often make multiple trades daily. It requires close monitoring of stock prices, quick decision-making, and a high-risk tolerance.

🔹 Swing Trading:

Swing trading expands the trading timeframe to encompass several days or even weeks. Traders look for short- to medium-term price movements, aiming to capture “swings” in stock prices. It requires a bit more patience than day trading and is suitable for those who can’t dedicate all their time to the market.

🔹 Long-Term Investing:

Long-term investing, as the name suggests, involves holding stocks for an extended period, typically years or even decades. Investors focus on the fundamentals of the companies they invest in and believe in their long-term growth potential. This style is often less stressful and more aligned with traditional investing strategies.

📊 Positions: Going “Long” and “Short”

Understanding trading positions is essential for grasping the dynamics of stock trading. There are two primary positions:

🔹 Long Position:

When you take a long position, you are buying a stock with the expectation that its price will rise over time. You intend to profit from the stock’s potential appreciation. Long-term investors often adopt this position, holding onto their investments through market fluctuations.

🔹 Short Position:

In contrast, a short position involves selling a stock you don’t own, with the anticipation that its price will fall. This is a more advanced strategy often used by experienced traders. Shorting allows you to profit from declining stock prices, but it comes with increased risk and complexity.

By exploring these trading styles and understanding the concept of going “long” and “short” in the market, you’ll be better equipped to choose the approach that aligns with your financial goals, risk tolerance, and available time for trading.

🌐 Step 9: Two Approaches to Stock Analysis

Now, let’s dive into the fascinating world of stock analysis, where investors use two distinct approaches to unravel the mysteries of the market. These methodologies are fundamental analysis and technical analysis, each with its unique lens for interpreting stock performance.

🔍 Fundamental Analysis:

Fundamental analysis resembles a deep dive into a company’s financial health—a thorough medical check-up for your investments. It involves scrutinizing a company’s financial statements, including the balance sheet, income statement, and cash flow. This meticulous examination helps investors assess a company’s profitability, debt levels, and overall stability.

But it doesn’t stop there. Fundamental analysis also peels back the layers to explore the company’s management structure, competitive landscape, and the regulatory environment it operates in. By undertaking this comprehensive approach, investors gain insight into a company’s strengths, weaknesses, and its potential for future success. Think of it as the art of understanding a company from the inside out.

🔍 Technical Analysis:

On the other side of the stage, we have technical analysis—a performance-driven approach to stock analysis. Instead of digging into financial statements, technical analysts are focused on studying a stock’s past price performance and trends. It’s like reading the sheet music of the market.

Technical analysts employ a repertoire of indicators, including moving averages, volatility, momentum, relative strength index (RSI), and volume data. These tools help identify patterns and trends in a stock’s historical price movements. By deciphering these patterns, investors seek clues about the stock’s current market value and its potential for future growth. It’s akin to interpreting the rhythms and melodies within the stock’s price history.

🔮 The Caveat: No Crystal Ball

Whether you choose to follow the fundamental or technical path, it’s crucial to understand that no one holds a crystal ball capable of predicting stock prices with absolute certainty. The stock market is a complex orchestra, influenced by a multitude of factors, some predictable and others entirely unexpected.

As with any investment, there are inherent risks, and no analysis can eliminate uncertainty entirely. Therefore, meticulous research and a well-informed strategy are your best allies on this investment journey.

So, whether you prefer dissecting financial statements or deciphering price charts, both fundamental and technical analysis are valuable tools in your investor’s toolkit. Choose your approach, embrace the complexities of the market, and remember that the stock market is a captivating performance with no shortage of surprises.

🌐 Step 10: Understand Risk and Return

In the world of investments, understanding the intricate dance between risk and return is paramount, especially when it comes to the captivating realm of stocks. To truly harness the potential of stock market returns, you must acquaint yourself with the risks and rewards that accompany this investment avenue.

⚡ Risk: The Unpredictable Companion

Stocks are renowned for their potential for both exhilarating highs and gut-wrenching lows. The roller-coaster ride of stock prices can lead to significant drops over short periods. These fluctuations can be triggered by a myriad of factors, including shifts in market conditions, a company’s financial performance, international economic developments, and much more. As an investor, staying attuned to news and events related to your investments is essential to navigate these twists and turns.

🎢 Volatility: The Roller-Coaster Thrills

Stocks possess a unique characteristic—volatility. This term encapsulates the propensity of stocks to exhibit rapid and sometimes dramatic price movements. The stock market can be an unpredictable stage, where prices swing both up and down with intensity. It’s akin to a thrilling roller-coaster, where exhilarating climbs are followed by heart-pounding descents. Consequently, investors should refrain from making snap judgments based solely on short-term gains or losses.

🍀 Rewards: The Potential Harvest

While stocks bring their share of unpredictability, they also offer the allure of substantial rewards. Over the long term, historical data shows that stocks have delivered strong returns, often outpacing other investment options. The potential for growth and wealth accumulation through stocks remains a compelling reason why many investors embark on this journey.

In conclusion, when you venture into the world of stocks, you embark on a journey filled with excitement, unpredictability, and the potential for significant gains. It’s essential to understand that no investment—stocks included—is without risk. Therefore, to learn stock market investing, staying informed, and maintaining a long-term perspective are invaluable tools in your pursuit of financial success in the world of stocks.

🌐 Step 11: Cultivate Your Investment Education

In the ever-evolving landscape of finance and investments, the pursuit of knowledge is a cornerstone of success. Just as you allocate resources to invest in stocks, it’s equally crucial to invest in your own education to navigate the complexities of the market effectively.

Here is some resources provide valuable insights into market dynamics, trading strategies, and financial instruments. Through comprehensive learning, you’ll be better equipped to make informed investment decisions.

📚 Trading Courses: Unlocking Market Wisdom

For beginners and seasoned investors alike, trading courses are a gateway to a deeper understanding of the market. These courses cover a spectrum of topics, from basic concepts to advanced strategies. They serve as a structured path to enhance your market knowledge and trading proficiency.

One notable example is StockOdds, a premier trading course that offers a treasure trove of educational materials and insights. Through these courses, you can sharpen your technical analysis skills and gain the confidence to navigate the markets effectively.

Investing in your education is an investment in your financial future. The resources available, such as market and trading education, paper money trading platforms, and comprehensive trading courses, empower you to learn stock market investing and navigate the complex world of finance with confidence. Your dedication to learning can be a catalyst for success in the realm of investments.

🌿 To learn more about StockOdds, take a look at my comprehensive review in this article:

“Unveiling the Best Stock Trading Course: A Comprehensive Review of StockOdds.“

💻 Paper Money Trading: Learn Stock Market Investing by Trading Simulator Without Risk

Paper Monday Trading (trading simulator) is a unique concept that lets you practice trading without committing real funds. It’s akin to a flight simulator for traders, offering a simulated environment where you can execute trades and refine your strategies, all without risking a single dime of your money. It’s the ideal playground for both aspiring and seasoned traders to experiment, learn, and fine-tune their techniques.

TradingView offers an invaluable platform for paper money trading. This innovative feature allows you to practice trading without risking real capital. You can also explore their instruction page, guiding you through the nuances of paper trading, and a mobile version demo page for on-the-go learning.

Allocating resources to your education is an investment in securing your financial future. The resources available empower you to learn stock market investing and navigate the complex world of finance with confidence. Your dedication to learning can be a catalyst for success in the realm of investments.

🌿 To learn more about TradingView, take a look at my comprehensive review in this article:

“7 Powerful Key Features of the Best Trading Chart Platform: TradingView.“

🌐 Step 12: Utilize Reliable Tools

As you embark on your investment journey, having access to dependable tools can make all the difference. For beginners, these resources are essential to learn stock market investing and making well-informed decisions in the world of investing:

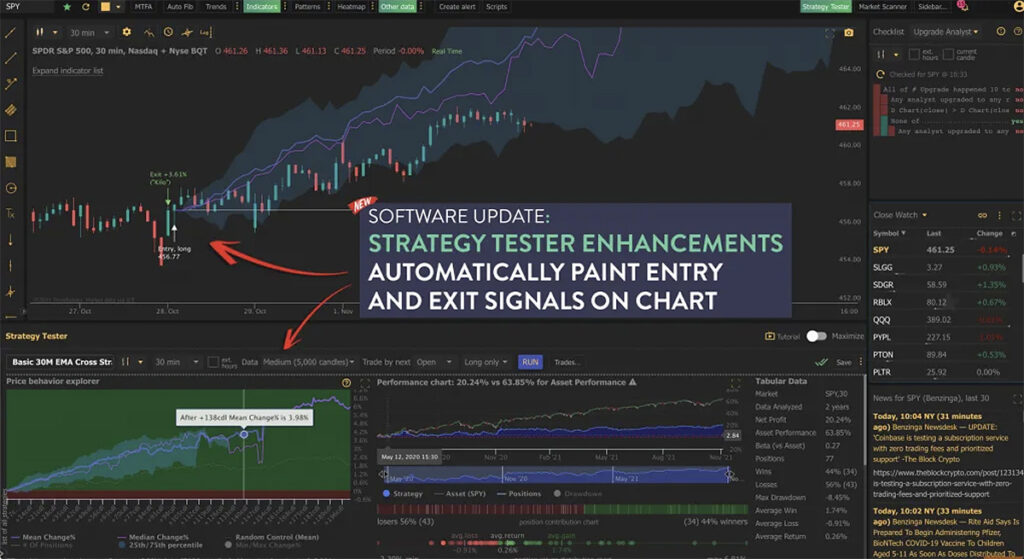

🔸 TradingView: Your Charting Companion

TradingView, introduced earlier in the paper trading section, is also an invaluable tool for chart analysis and social trading.

As a charting and social trading platform, TradingView is a must-have for traders of all levels, from novices to seasoned investors. It offers a comprehensive suite of tools designed to help you achieve the best trading results. With TradingView, you can delve into thorough chart analysis and make data-driven decisions, all in one user-friendly platform.

🔸 eToro: The Gateway to Social Trading Success

eToro is the perfect platform for beginners looking to enter the world of trading. With a minimum deposit of just $200, you can start copying the trades of experienced investors using eToro’s CopyTrader feature. There are no hidden fees, making it accessible for newcomers.

Trusted by over 10 million users worldwide, eToro offers a wide range of trading instruments, including indices, stocks, ETFs, Forex, commodities, and cryptocurrencies. You can choose professional traders to follow based on their past performance, win rates, and more, making it a beginner-friendly way to learn and earn in the stock market.

🔸 TrendSpider: Unleash Automated Analysis

TrendSpider is your ally in the world of stock analysis, leveraging the power of automated technical analysis. This platform excels at helping traders spot trends quickly, thanks to a combination of traditional and proprietary tools. Its robust scanning feature evaluates chart patterns with various indicators, all of which can be conveniently viewed in multi-chart layouts. While TrendSpider caters to a range of trading styles, it’s particularly well-suited for day traders, swing traders, and general investors.

🌐 Step 13: Mastering Basic Technical Chart Analysis to Learn Stock Market Investing

Technical chart analysis is an indispensable tool employed by traders and investors to make informed decisions within the financial markets. Charts serve as visual representations of price movements, aiding in the identification of trends, patterns, and potential support and resistance levels. This guide serves as an introduction to the fundamental components of technical chart analysis tailored for beginners.

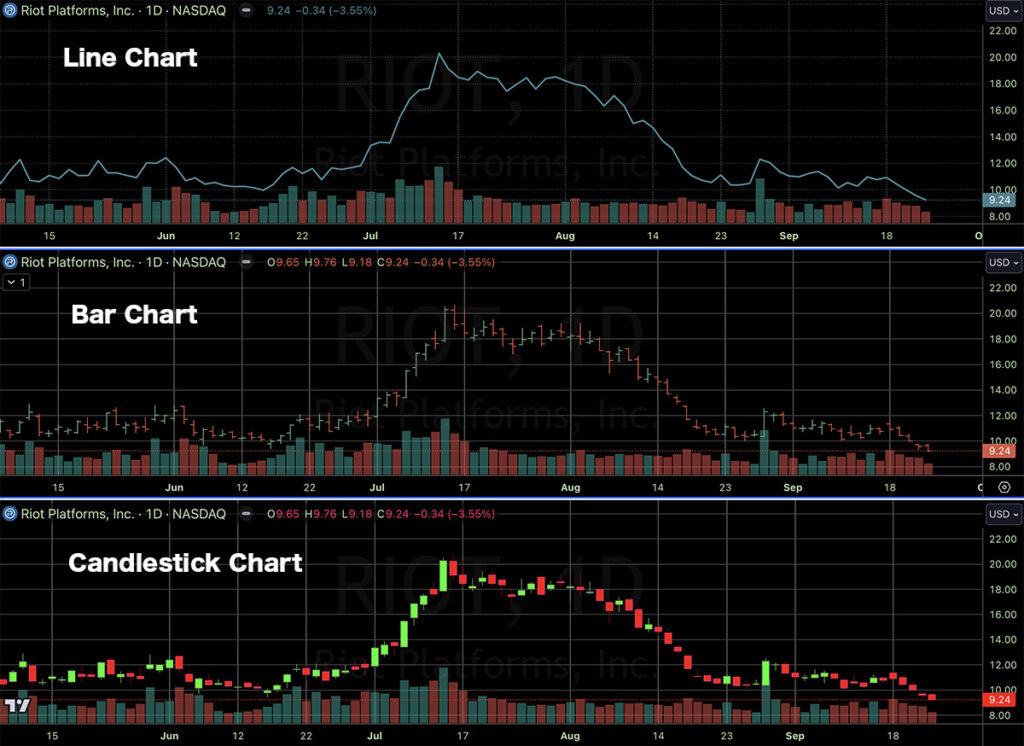

1️⃣ Types of Charts

- Line Chart: Connects closing prices over time to form a simple, continuous line.

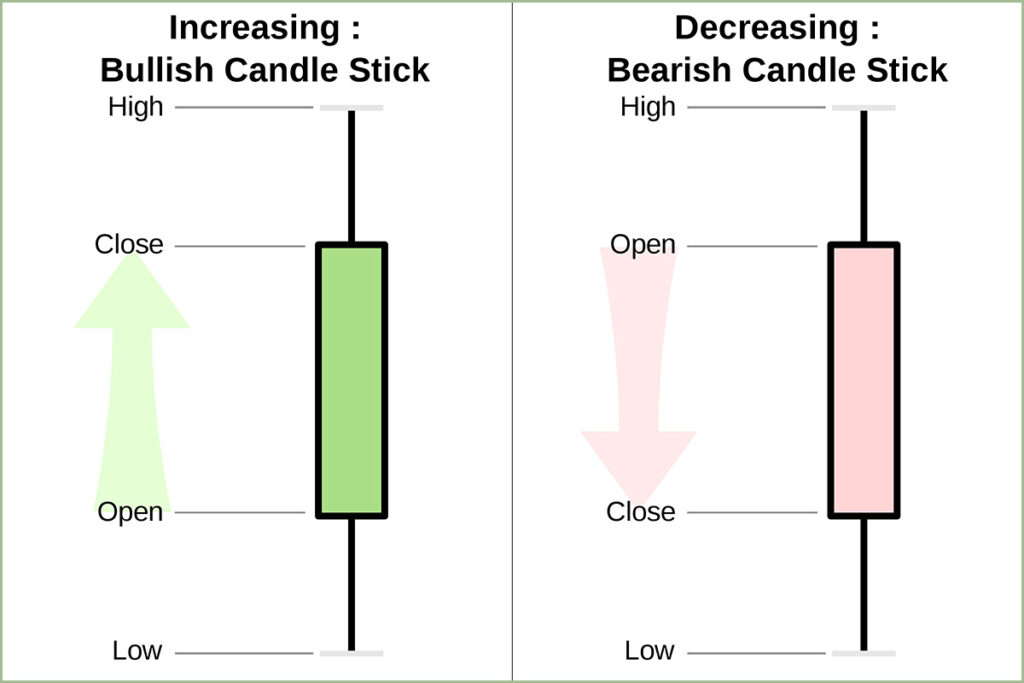

- Bar Chart: Depicts price data using vertical bars, displaying high, low, open, and close prices.

- Candlestick Chart: Similar to bar charts but provides more detailed insights using candlestick patterns.

2️⃣ Timeframes

- Select a timeframe aligned with your trading or investment objectives (e.g., daily, weekly, or intraday).

- Longer timeframes cater to long-term investors, while shorter ones suit day traders.

3️⃣ Trend Analysis

- Recognize trends by assessing the direction of price movements.

- Uptrend: Characterized by higher highs and higher lows.

- Downtrend: Noted by lower highs and lower lows.

- Sideways (Range-bound): Prices fluctuate within a horizontal range.

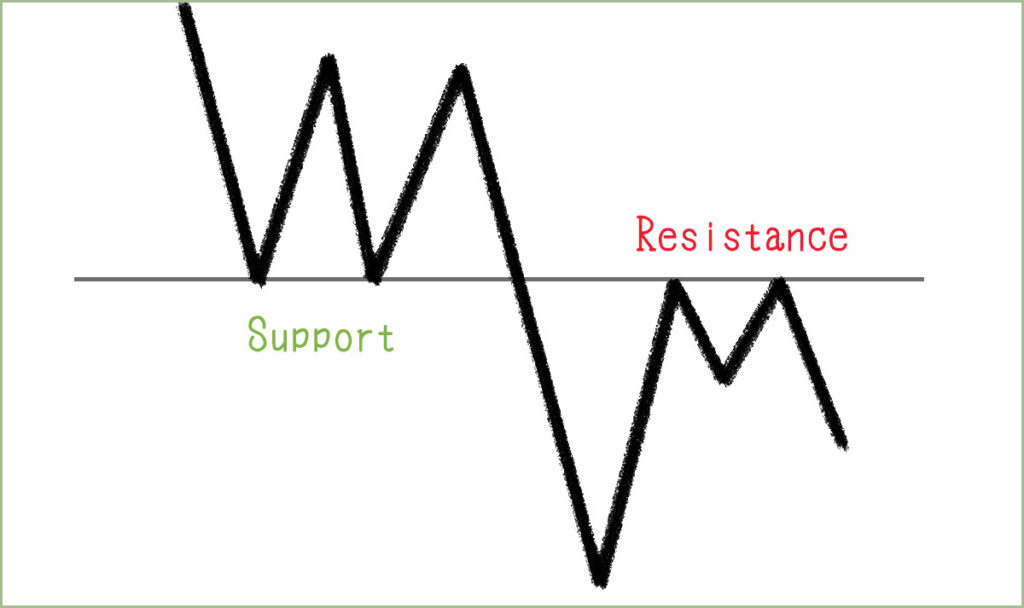

4️⃣ Support and Resistance

- Support: A price level where an asset tends to find buying interest, preventing further decline.

- Resistance: A price level where selling interest typically restricts price advances.

5️⃣ Moving Averages

- Moving averages smooth price data to reveal underlying trends.

- Simple Moving Average (SMA) and Exponential Moving Average (EMA) are frequently employed.

- Crossovers between short-term and long-term moving averages can signal shifts in trends.

6️⃣ Chart Patterns

- Recognize common patterns like Head and Shoulders, Double Top, Double Bottom, and Flags.

- These patterns offer insights into potential future price movements.

7️⃣ Candlestick Patterns

- Widely recognized candlestick patterns comprise Doji, Hammer, Shooting Star, and Engulfing patterns.

- These patterns offer valuable information about market sentiment.

8️⃣ Technical Indicators

- Oscillators (e.g., RSI, Stochastic) and momentum indicators (e.g., MACD) help gauge overbought or oversold conditions and market momentum.

- Volume indicators (e.g., Volume bars) reveal the strength of price movements.

9️⃣ Risk Management

- Employ stop-loss orders as a means to mitigate potential losses.

- Evaluate your risk tolerance and determine your position size before entering a trade.

🔟 Practice and Education

- Begin with a demo account to learn stock market investing and practice chart analysis without risking real capital.

- Continue learning and honing your skills through resources like books, online courses, and forums.

Technical chart analysis serves as an invaluable skill for traders and investors to navigate financial markets effectively. While this guide provides a foundational overview, remember that mastering chart analysis necessitates practice, ongoing learning, and the development of a well-considered trading or investment strategy.

🌐 Step 14: Learn Emotion Control in Trading

Trading involves real money, and that alone can trigger a range of emotions, including fear, greed, excitement, and anxiety. These emotions can cloud your judgment and lead to impulsive decisions that may not align with your trading strategy.

💡 Tips for Controlling Emotions

✔️ Create a Trading Plan:

Having a well-defined trading plan with entry and exit strategies can help you stay focused and avoid impulsive decisions.

✔️ Set Realistic Goals:

Establish achievable goals and accept that losses are a part of trading. Avoid aiming for quick riches.

✔️ Use Risk Management:

Determine the amount of capital you’re willing to risk on each trade and stick to it. Stop-loss orders are crucial tools for risk management.

✔️ Practice Patience:

Avoid rushing into trades. Wait for your pre-defined setup to occur rather than chasing opportunities.

✔️ Stay Informed, Not Emotional:

Base your decisions on analysis and research, not on emotional reactions to market events.

✔️ Review and Learn:

After each trade, analyze what went right and what went wrong. Use these insights to improve your future trades.

✔️ Limit Screen Time:

Excessive monitoring of price movements can lead to emotional reactions. Set specific times for analyzing the markets.

✔️ Mental and Physical Health:

Maintain your mental and physical well-being. A healthy lifestyle can help you manage stress and emotions better.

Controlling emotions is a vital skill in trading. As a beginner, it’s natural to experience emotional ups and downs, but learning to manage them is crucial for long-term success. Remember that trading is a journey of continuous improvement, and emotional mastery is a valuable step in that journey. By implementing these tips and staying disciplined, you’ll be better equipped to learn stock market trading and navigate the emotional challenges of trading and make more rational decisions.

🍵 Conclusion

In the world of stock trading, knowledge is your compass, strategy your map, and emotional control your anchor. This guide has provided a comprehensive overview for beginners to learn stock market investing, covering everything from understanding the stock market and different investment avenues to technical chart analysis and emotional discipline.

Remember that the path to successful stock trading is a journey, not a destination. It requires continuous learning, practice, and adaptation. By developing a sound understanding of the market, honing your analysis skills, and mastering your emotions, you can navigate the financial landscape with confidence and increase your chances of achieving your investment goals.

As you embark on your trading adventure, always prioritize risk management, stay true to your trading plan, and maintain a healthy balance between ambition and caution. With dedication and perseverance, you can make the stock market work for you, realizing your financial aspirations and securing your financial future.

Happy trading!

🌿 Frequently Asked Questions (FAQ)

Q1: What’s the first step to learn stock market investing as a beginner?

The initial step is to determine your investing approach. Ask yourself what type of investor you want to be. You can choose to invest in individual stocks, opt for index funds, or use a robo-advisor. Each approach caters to different preferences and time commitments.

Q2: How can I learn stock market investing without a financial background?

Learning stock market investing doesn’t require a financial background. Start with educational resources, books, online courses, and investment platforms that offer beginner-friendly tools and information. Focus on understanding the basics and gradually build your knowledge.

Q3: Is stock market investing risky for beginners?

Yes, stock market investing carries inherent risks, but it can also be rewarding. Beginners should start with a well-defined strategy, diversify their investments, and consider long-term goals. It’s essential to understand the risks and make informed decisions.

Q4: Can I invest in stocks with a limited budget?

Absolutely! You can invest in stocks with a limited budget by considering fractional shares, which allow you to invest in a portion of a stock. Additionally, index funds and robo-advisors often have low minimum investment requirements.

Q5: How do I stay informed about my stock investments?

To stay informed, regularly review your portfolio, monitor financial news, and track the performance of your investments. Many investment platforms also provide notifications and updates to help you stay in the know.

Q6: What’s the best strategy for long-term stock market investing?

Long-term stock market investing often involves a buy-and-hold strategy. Focus on companies with strong fundamentals, diversify your investments, and stay committed to your financial goals over time.

Q7: Can I change my investing approach over time?

Yes, you can adjust your investing approach as your financial goals and circumstances evolve. Many investors start with one approach and transition to another as they gain experience and confidence.

Q8: Are there risks involved in day trading and swing trading?

Yes, both day trading and swing trading come with higher risks due to their short-term nature. These strategies require active monitoring, quick decision-making, and a deep understanding of market dynamics. It’s crucial to be well-informed and risk-aware.

Q9: How can I manage emotions when investing in the stock market?

Emotional control is essential in stock market investing. Develop a trading plan, set realistic goals, and practice patience. Avoid making impulsive decisions based on emotions, and continuously review and learn from your trades.

Q10: Where can I find reliable resources to learn stock market investing?

To learn stock market investing, consider enrolling in online courses or reading books on the subject. There are also numerous YouTube channels and forums where traders share their insights.

Additionally, if you’re looking for a comprehensive online trading course, we recommend checking out StockOdds. They offer a range of educational resources and insights that can help you sharpen your technical analysis skills.

👉👉 Connect with Me: Instagram and StockTwits ✌️